pinellas county sales tax 2020

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. On Any Device OS.

The 7 sales tax rate in Pinellas Park consists of 6 Puerto Rico state sales tax and 1 Pinellas County sales tax.

. PdfFiller allows users to Edit Sign Fill Share all type of documents online. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Pompano beach fl sales tax rate.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas. 72 rows The plan has been to slowly but surely reduce the sales tax rate on commercial rent to zero and weve seen reductions in the tax rate for several years now.

AN ORDINANCE OF THE COUNTY OF PINELLAS PROVIDING FOR THE REPEAL OF CHAPTER 1 18 ARTICLE IV DIVISION I SECTIONS 118-161 THROUGH 118-235 OF. The minimum combined 2022 sales tax rate for Pinellas County Florida is. Give it a Try.

There is no applicable city tax or special tax. Ad Florida State Sales Tax registration application for new businesses. Plantation fl sales tax rate.

Floridas general state sales tax rate is 6 with the following exceptions. Floridas statewide sales tax rate is 6 percent but a. The December 2020 total local sales tax rate was also 7000.

Florida has a 6 sales tax and Pinellas County collects an additional 1. Tangible personal property is. 6 rows the pinellas county florida sales tax is 700 consisting of 600 florida state.

You can print a 7 sales tax. This includes the rates on the state county city and special levels. Discretionary sales surtax applies to the first 5000 of the sales amount on the sale use lease rental or license to use any item of tangible personal property.

The Penny and sales tax rates Pinellas County has a sales tax rate of 7 percent close to the statewide average rate of 68 percent. The current total local sales tax rate in Pinellas Park FL is 7000. What is the sales tax rate in Pinellas County.

Fast Secure - Florida State Sales Use Tax Application - Florida State Sales Tax. This is the total of state and county sales tax rates. The current total local sales tax rate in Pinellas County FL is 7000.

The average cumulative sales tax rate in Pinellas County Florida is 701 with a range that spans from 7 to 75. The December 2020 total local sales tax rate was also 7000. Port saint lucie fl sales tax rate.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Pinellas County Sales Tax Rates for 2022. The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales.

Florida Property Tax H R Block

Florida County Sales Tax Rates 1992 2006 Download Table

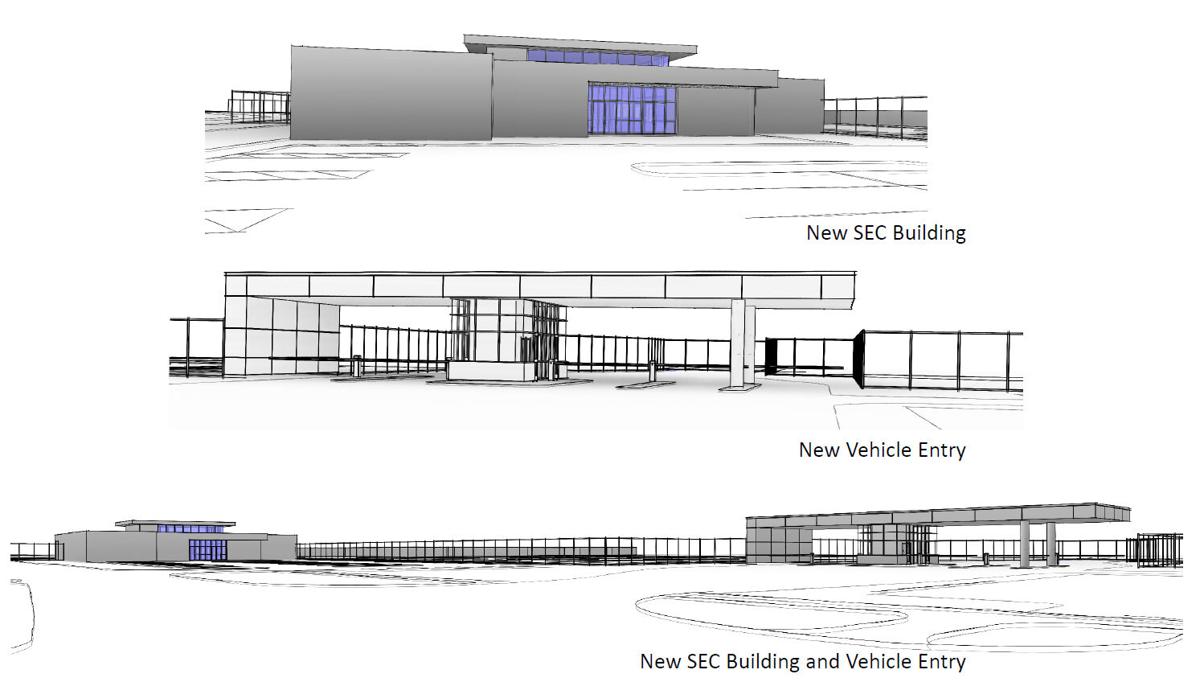

Pinellas County Commission Oks Agreements For Jail Security And Entry Center Project Pinellas County Tbnweekly Com

U S Sales Tax Setup For Business Central

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Fy21 Adopted Annual Operating And Capital Budget Pinellas County

Florida Dept Of Revenue Property Tax Data Portal

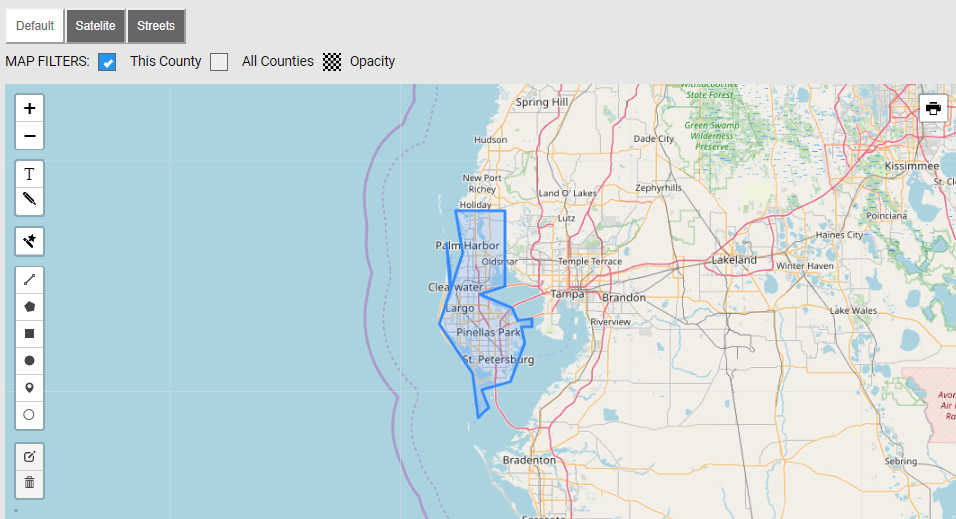

Site Selector Pinellas County Economic Development Pced

Back To School Sales Tax Holiday Starts Aug 7 Wfla

Dcps On Twitter Oldest Schools Duval Has Florida S Oldest Schools And No Alternative Funding Source To Pay For Repairs Renovations And Rebuilds That S Why The Duval School Board Is Asking Voters On

Pinellas County Keeps 2021 Property Tax Rates The Same And Prepares For Covid 19 Impacts

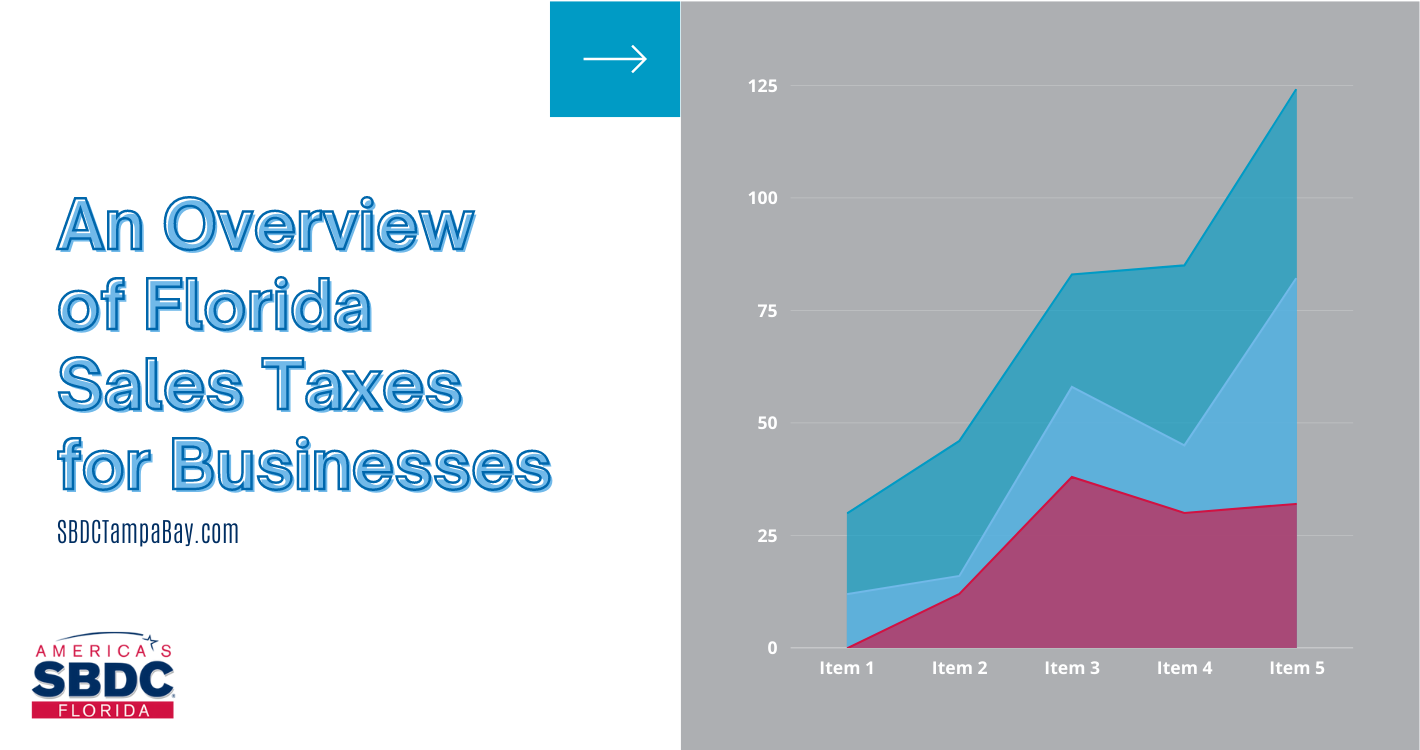

An Overview Of Florida Sales Taxes For Businesses

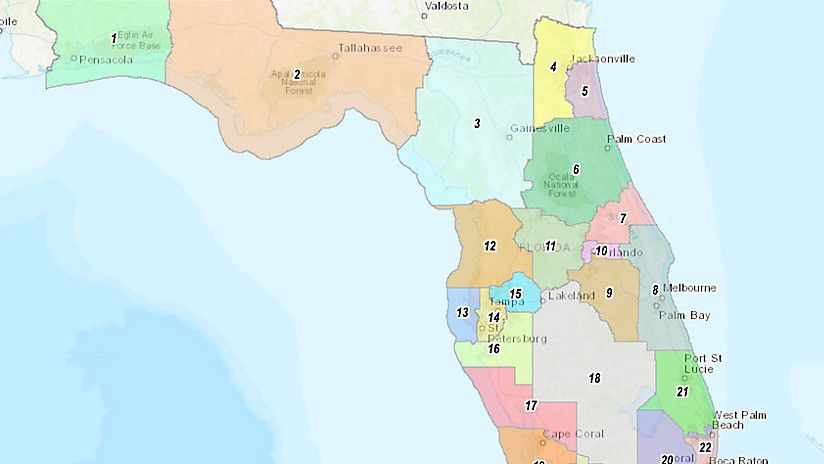

Pinellas Congressional Democrats On New Challenges

Pinellas Gateway Mid County Area Master Plan By Wrtdesign Issuu

Tax Collector Executive Team Pinellas County Tax Collector

U S Sales Tax Setup For Business Central

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News